My Plan to Reach Financial Independence

It makes sense to start off with:

what does financial independence mean to me?

Investopedia defines it as:

when you can live the quality of life you desire without having to work any longer

This definition has two key parts to me:

- quality of life you desire

- without having to work

What is the quality of life that I desire?

Here's a list of things that I would love to have the freedom to do/have.

Qualitative Expenses

- Travel. I'd like to not only have the freedom to travel whenever and as frequently as I want to, but also the financial backing to be able to stay in relatively high-quality places, get involved in any local experiences and eat at fancy restaurants (where I feel like it), whilst not having to (excessively) worry about budget.

- House. I'd like to own my own place in a location that I want to (e.g. close-ish to the beach) and styled with decor that I like and that I (for the most part) didn't have to think about finances for.

- Family & friends

- If I want to see my family or friends and I haven't seen them for ages, then I would love to be able to do nice things like send them flight tickets to travel to my city to come to visit me

- I want to buy things for my loved ones that they will appreciate, irrespective of their price. This doesn't necessarily mean expensive objects, it could be thoughtful things like flowers or skydiving tickets or anything really... the point is that I don't want money to be the thing that restricts me. I want to be restricted by a lack of ideas.

- As my parents get older, I want to be able to pay for them to have the support they need, when I'm not around, to enable them to live the most independent and enjoyable life they can.

- Pets. I've always wanted a dog and I never had one growing up because it would've added a financial burden to our family's life that we didn't need to introduce. Well I don't want that burden to have to be a consideration.

- Health.

- Though I've always been someone who exercises regularly, I've also always struggled to get the body that reflects how important health is to me. I've always been skinny-fat and despite my best attempts at going to the gym, running, playing sports, trying to maintain good nutrition, I've never been able to achieve this goal. It's actually been a source of discontent in my life for many years. I'd love to be able to have a personal trainer and a dietician that can help me get to my desired physique. Sure, this is absolutely not necessary to develop a fit physique and I'm sure if I dedicated myself fully to this I could do it without the help, but if I can leverage money to help me achieve this goal that I've always struggled with, then why wouldn't I do it?

- I've always wanted a therapist. Not because I think I've got some inner demons and mental health issues that I need to work through, but rather because I think having a trained outsider perspective on the workings of my mind and my beliefs would help me identify flaws in my thinking and help me grow as a person.

With all of these things I've listed, it's not even that I necessarily want to have the 'nicest' or most luxurious things possible, it's more that I don't want this arbitrary human creation, money, to place restrictions on the way that I live my life. I want to be free.

Quantitative Expenses

While it's all well and good to have a qualitative description of what I want in my life, a more practical approach would be to use numbers. So here's a rough estimate of how much I anticipate I'd want to spend on things per year, with prices being calculated based on the 2022 economy.

Now it goes without saying that all of the below aren't things I want or need anytime soon, but this freedom is something I'd love to aim for within the next 10 years.

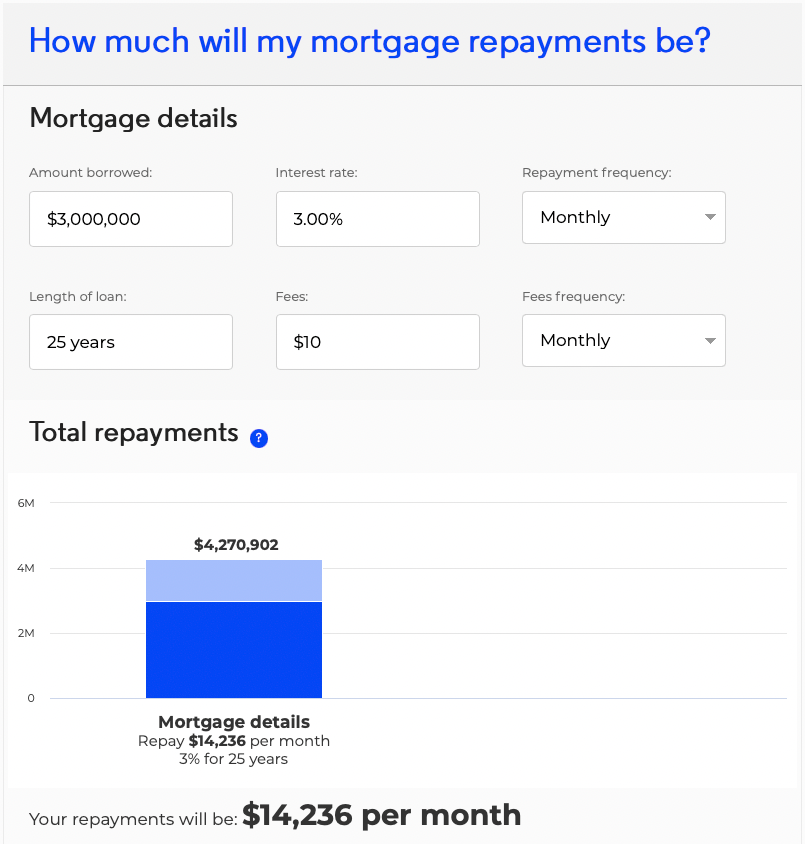

- House

- A conservative estimate for a 4-bedroom house in the city suburbs in Newcastle, Australia is $3.5M.

- Clearly buying this with cash is a ridiculous proposition, so I'd ideally get a mortgage on it.

- Assuming I put a $500K deposit down, this would mean monthly repayments of $14,236

- Total = $170,832 annually [jesus christ that's a lot of money]

- Travel

- International

- Let's say a conservative estimate for a no-expense-spared week-long international trip costs $20K for a family of 4.

- Ideally, I'd like to do one per year.

- Domestic

- Let's say a conservative estimate for a no-expense-spared five-day domestic trip costs $10K for a family of 4.

- Ideally, I'd like to do 3 per year.

- Extra $20K just as a buffer for other kinds of trips [why not, this is all theoretical nonsense anyways]

- Total = $70K annually [well that's just absurd]

- International

- Family & friends

- Gifts

- Let's assume I spend $20K on gifts per annum, including paying for family/friends to travel to visit me.

- Support for parents

- Let's assume it costs $20K per annum to pay for support services like a cleaner, someone to mow the lawn etc.

- Total = $40K annually

- Gifts

- Personal services

- Let's just assume it costs $100K annually to have my own personal trainer, dietician, therapist etc.

- Total = $100K annually

- Other

- This includes stuff like groceries, eating out, haircuts, subscriptions and memberships, stuff (like camera gear, tech, books etc.), kids' sports and equipment, education, pets, petrol etc.

- Total = $120K annually [bruh]

- Charity

- Total = $100K annually

TOTAL ESTIMATED LIFESTYLE EXPENSES = $581,000 pa

Therefore, let's say that my annual burn rate is around $600,000 per year.

Before we go on, I want to reiterate that the point of all this isn't to say that this is how much I want to spend each and every year. I'd be surprised if I spent even a sixth of this in a year.

But the point is, I want to have the freedom to live this kind've lifestyle if I wanted to.

But wait, I want to get to the point where I have sufficient money to live like this if I wanted to and then choose not to live like this if I don't want to.

How do I achieve this quality of life without working?

Now to the second part of this financial independence definition, the without having to work part.

There are three ways that I can see that someone can get to this state of not having to work.

- A sufficient financial nest egg has been created whereby the passive income from compounding alone is able to meet the demands of the burn rate without eating into the source.

- The work that is being performed feels like play (i.e. is so fun that it doesn't feel like work) AND the income is sufficient to meet the burn rate + extra for savings/investments to permit this lifestyle once someone decides they no longer want to work.

- A business that requires little to no time input is created that generates passive income sufficient to meet the burn rate.

Let's break these down further and assess the practicalities of each pathway.

1) Financial Nest Egg

How much capital would we need to provide a passive income of $600K after taxes?

Let's start with the taxes.

An 'net income' of $600K through dividend yield automatically means we would be in the highest income tax bracket where essentially half our money is given to the government through taxation.

In other words, we would roughly need a gross (pre-tax) yield of $1.2M in order to receive a net (after-tax) yield of $600K.

If we assume a yield of 3% (after inflation, to prevent reduction of our capital), then our capital would need to be:

Capital = $1.2M/0.03 = $40M

We would need to have $40 million dollars invested (in something that yields at least 3% after inflation) to receive $600K pa in income to meet our burn rate.

2) Work = Play

There are two considerations here:

- How much income do we need to be paid to permit this lifestyle?

- Does any job exist where we would be happy to work full-time for forty years?

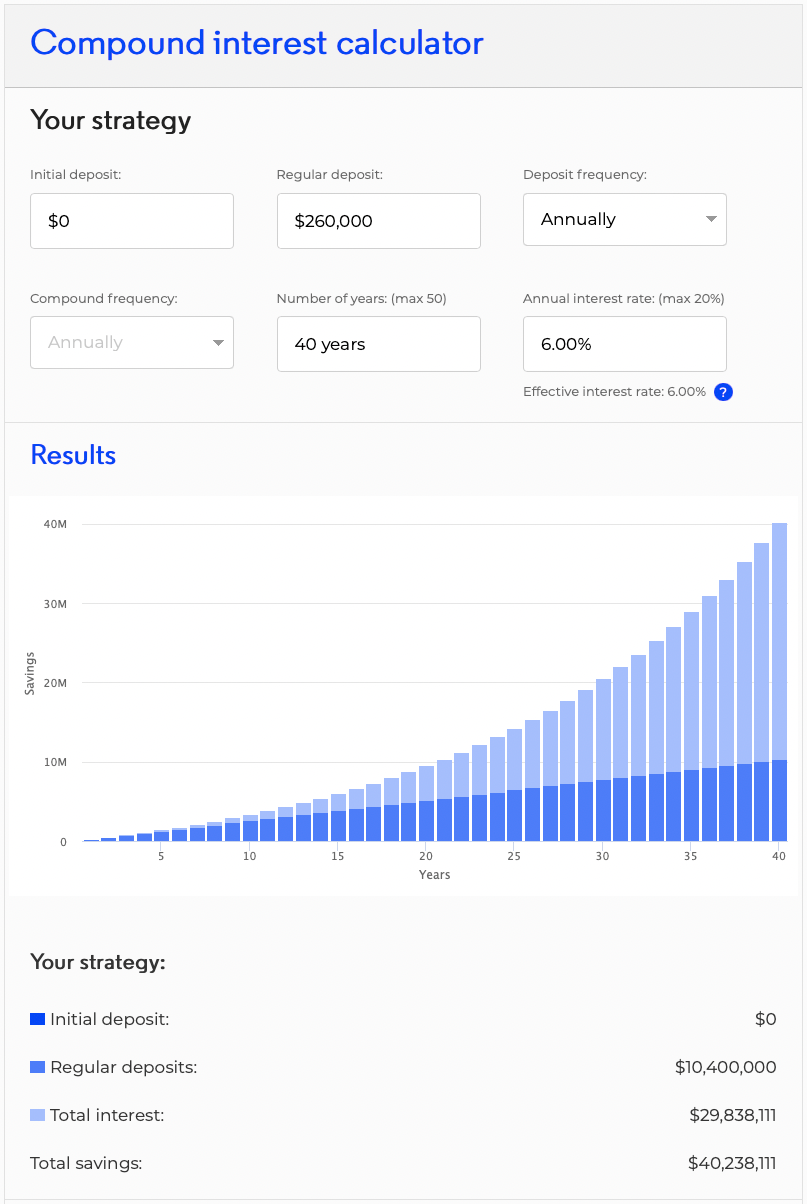

First, we would need to calculate how much we would need to invest each year such that by the end of our 40-year career, when we're tired of working (even though it was a job we enjoyed), we have enough to continue to live the lifestyle we want to.

Assuming a compound interest rate of 6% pa, we would need to invest around $260K pa to get to that number of $40M which provides a yield of $600K pa once we reach retirement.

Therefore, out net income would need to be $860K pa.

If we use the same rough estimate of taxes being 50% of gross income, then we would need a gross income of $1.72M.

Additionally, we would need to find a job that we loved so much that we were able to do it five days a week for forty years and still find it fun every day.

I don't know about you but I don't know any job that meets one let alone both of those criteria.

3) Business with Passive Income

Let's use the same numbers as the income example above, because:

- We likely wouldn't want to earn just enough to simply cover our burn rate without having some money to invest as well.

- I don't understand corporation taxation and if we simply assume it to be the same as the income tax rate, this would be an overestimation of the tax we would need to pay (the real tax should be less than this).

Therefore, the business would need to have an annual gross profit of at least $1.72M.

It is considerably easier to scale a business to provide a gross profit with this value than it is to find an employer willing to pay a salary that high.

Additionally, businesses provide leverage through automation (through computers and programming) and human capital. Therefore, it's plausible that one could get to a point with their business where they are not (or minimally) involved in the operations of the business, thereby receiving true passive income.

Conclusion

I think it's pretty obvious that the clearest pathway for me to reach financial independence is by starting a business.

And so that's what I plan to do.

Stay tuned to see what future projects I'm involved in.

After reading all this, you might think this means I'm going to be quitting Medicine. That's not the case.

As I mentioned in this blog post, one of my major goals with my career is to feel an emotional connection and derive satisfaction from my work, and as I describe in the post, Medicine is one of the unique professions that provides an opportunity to do this. And so I would like it to remain a part of my overall career for as long as I'm working.

But who knows what the future holds. Plans are only worth so much.